Money

Money is something that is accepted as a form of payment for products or services, or for the payment of obligations. It is a medium of exchange with a specific value by which the value of all other things can be measured, which greatly facilitates trade and allows modern economies to enjoy the benefits of the division of labor.

Barter

Without money, trade would have to be conducted through barter, where traders would exchange the things that they want less for things that they want more. The problem with barter is that it is difficult and time-consuming to determine the value of specific items. Additionally, most forms of barter cannot be broken down to buy things of lesser value, nor is it easily transportable. Barter also suffers from the requirement that the traders must have a coincidence of wants — that each trader happens to have what the other wants. Money solves these problems of barter.

Money as a Medium of Exchange

Money is simply a common medium of exchange that everyone agrees upon, and, thus, they accept it as a form of payment for their goods and services. Money has 3 properties that make it desirable to use it as a medium of exchange. Money provides:

- a means of payment,

- a unit of account,

- a store of value.

Means of Payment

Money is an accepted unit of exchange for goods and services or for the satisfaction of obligations, such as debt, because it is standardized into specific units with specific values; hence, it is much easier to assess its value and can be readily exchanged. It is divisible into smaller units to make smaller payments, or large amounts of money can be carried with much less burden than carrying the equivalent value of barter. For instance, a $100 bill in American currency weighs no more than a $1 bill.

Unit of Account

Because money is standardized into specific values, it can be used to price goods and services, and allows the easy comparison of prices. Because the value of money is determined by general agreement, the condition of the money is irrelevant to its value. For instance, if a farmer wanted to buy a cow and offered a horse in exchange, then obviously, the seller of the cow would want to examine the condition and age of the horse, since that would determine the value of the horse; likewise for the seller of the horse. When money is offered, only the amount matters, not its condition.

Prices provide information for consumers and producers who allocate economic resources to their most desirable uses. Items in demand command a higher price relative to the costs of the resources to produce them, which induces sellers to provide more of those items. Conversely, items in lower demand have lower prices in relation to their cost of production, and, thus, sellers will allocate fewer economic resources to provide those items.

Store of Value

Money must keep most of its value in time; otherwise, people would not accept it for payment. This means that money has to be relatively scarce and that the supply of new money must either be difficult to produce or tightly controlled. Any increases in the money supply must be gradual and expand with the economy. Otherwise, the increase of the total quantity of money will reduce the value of money, which is a direct cause of inflation.

The currency itself must also be durable; otherwise it would eventually lose its value as money as it decays or disintegrates, and, thus, people would not keep it.

Gold

The best example of money that illustrates its properties is gold. Gold is universally accepted by most cultures as a means of payment because it is relatively scarce, and new supplies are difficult to find and mine. Being the most malleable and ductile of metals, it can also be easily cut into different sizes to correspond to specific values. It can be subdivided even more and still retain its value. It is also durable—it does not tarnish, corrode, or decay. Hence, it can be kept for a long time and still retain its value.

Commodity, Representative, Fiat, and Electronic Money

Money can be broadly classified as commodity money, representative money, fiat money, or electronic money.

Commodity Money

Commodity money has intrinsic value, such as salt in the Mediterranean region, silk in China, or gold and silver throughout the world, because these commodities have a value that is independent of its value as money. Gold, for instance, is extensively used in jewelry, and silver has many industrial uses.

Although commodity money is usable in some form other than as money, it also must satisfy the other characteristics of money. The commodity must be dividable into standardized quantities, so that different units of value can be created. It must be durable, so that it lasts; otherwise, it wouldn't function well as a store of value and it would have to be continually replaced. Small size and light weight are desirable for easy transport.

- Front and back of a Lydian Coin (Western Turkey), 700-637 B.C., which was the first known coin. Lydia was the first culture to issue coins for use as money.

- Coin used in Drachma, Thessaly (Eastern Greece), 400-344 BC.

Representative Money

Representative money is paper currency that can be exchanged for a fixed amount of a valuable commodity, usually gold or silver. Paper currency is convenient because it weighs little and much larger denominations can be printed that weigh no more than single units of currency. For instance, in 1715, Maryland, North Carolina and Virginia issued tobacco notes which could be converted to a certain amount of tobacco on demand, but were much easier to carry and to make large payments.

However, the problem with representative money is that its acceptance depended on the reputation of the issuer. This is why the people in early America accepted banknotes, because the bank stood ready to redeem their notes in specie, which were gold or silver coins. However, some banks issued more notes than they had specie; when the public found out, they would run to the bank with their banknotes to redeem them before the bank ran out. Such runs on the bank, as they were called, were a frequent occurrence in 18th and 19th century America, when many states did a poor job of monitoring the banks that they chartered. Eventually, starting in 1861, the federal government started issuing its own notes, that were backed by government bonds held at the United States Treasury.

Fiat Money

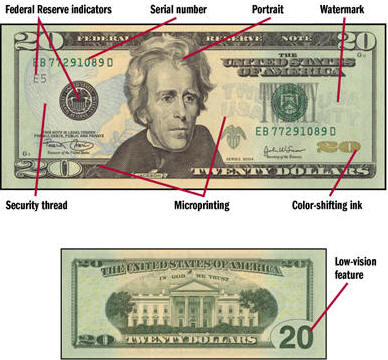

Fiat money has no intrinsic value nor can it be redeemed for specie. Its value originates from government decree, or fiat. The best example of fiat money is paper currency. The paper itself has very little intrinsic value, so fiat money can only serve as money if its production is tightly controlled. The production of fiat money is mostly controlled by governments. Governments maintain this control by using printing methods and materials that are difficult to reproduce, and by punishing counterfeiters with harsh penalties. For instance, in 12th century China, where the 1st paper currency circulated, the penalty for counterfeiting was beheading, and this was printed on the currency!

People use fiat money only if they believe that it can be used in the future and that it will not lose value. The government will also usually encourage the use of its money through the force of law. For instance, since 1862, all United States dollars were printed with the phrase "This note is legal tender for all debts, public and private."

Although the issuance of paper money in the United States began in 1690, the U.S. government did not issue paper currency with the intent that it circulate as money until 1861, when Congress approved the issuance of demand Treasury notes. All currency issued by the U.S. government since then remains legal tender, including silver certificates, which have a blue seal of the Department of the Treasury; United States notes have a red seal, and national bank notes have a brown seal. Most of the U.S. currency circulating today is in the form of Federal Reserve notes that have the green Treasury seal.

National bank note, Winters National Bank of Dayton, Ohio, printed in 1901. Note at the top middle of the currency's face the phrase "This note is secured by bonds of United States deposited with the U.S. Treasurer at Washington."

A modern 20-dollar Federal Reserve note illustrating the numerous details designed to thwart counterfeiting.

Electronic Money

Most money in most countries today exists only in electronic format, as records in the databases of financial institutions, which is why the United States Treasury no longer prints currency in denominations greater than $100. Law-abiding citizens use checks or electronic transfers for large payments, while organized crime and terrorist networks use cash. Hence, the elimination of large denomination bills is considered a potent weapon against organized crime and terrorists by making it inconvenient and risky to transfer large amounts of cash. Denominations greater than $100 were last printed in 1945, but were issued until 1969 by the U.S. Treasury.

Eventually, when the technology exists at a low enough cost, all money may become electronic because of its many advantages, both to governments and to the people. Electronic money can only exist if there are strong and stable financial institutions, because, like fiat money, its creation must be tightly controlled and people must have confidence that it can work. A great impetus to make all money electronic is that it may be the most effective tool to stop organized crime and terrorism, since electronic transactions are easily monitored and traceable, and tax authorities will certainly appreciate that tax evasion will be much more difficult.

Inflation

Inflation results when the supply of money increases faster than the economy expands, which results in higher prices. Sometimes, governments increase the money supply as an easy way to solve fiscal problems, but too much inflation can destroy the value of money. Inflation does the most damage to money as a store of value, since its value continually declines as more money is created. Rather than keeping it, people spend it as fast as possible before it loses value, which, in turn, causes prices to rise even more.

Inflation also limits money as a unit of account because prices are continually increasing so it is difficult to compare prices that are constantly changing.

Finally, if inflation is too high, then people stop using it as a medium of exchange, and start using barter or the currency of another country.

One of the reasons why there is more United States currency outside of the United States than within is because many people in certain countries do not trust their governments. They are afraid that their government will print too much money as an easy way to solve fiscal problems, which would reduce the value of the native currency held by the people. This happened in Argentina in the 1980's and in Russia in the 1990's. Hence, many of these people hold their store of value as United States dollars, mostly in the form of 100-dollar bills.

Dollarization is the most extreme form of currency failure, when people lose all faith in their currency and adopt the currency of another country. Usually, United States currency is adopted because it is considered one of the safest currencies in the world, and because many United States immigrants send U.S. currency to their relatives abroad. Most recently, in 2000, Ecuador adopted dollarization as a policy.

The Problem with Using Bitcoin and Gold as Money

Although inflation can be problematic, at least, in most cases, it is predictable. What is worse is a currency that can fluctuate up and down unpredictably. Ron Paul, a US Congressman, wants to go on the gold standard because its supply cannot be abused by the government. Gold has been, and still is, to some extent, used as money. Bitcoin is a new type of money based on cryptography, where supply is limited by the difficulty of creating new bitcoins. Although gold and bitcoins are sometimes used to pay for goods and services, they are most often held as speculative investments.

Although the supply of gold and bitcoins is limited, they cannot serve as a unit of account or as a store of value, because their value fluctuates considerably. Over the span of a few months, the US dollar value of bitcoin has varied from $130-$1242. Likewise, gold has reached almost $2000 an ounce, only to drop back to around $1200 an ounce.

People will only use money if they have confidence in it. When a medium of exchange fluctuates wildly in what it can be exchanged for, it cannot serve as a unit of value or as a store of value. For instance, if you earned your money in bitcoins and you wanted to save for a car over a 2-year period, then at the end of that period, you would not know if you had enough money to buy a Rolls-Royce or a scooter. Bitcoins, like gold, cannot serve as a unit of account, because it would be like trying to measure the length of objects using a tape measure where the length of its units continually changed. Imagine trying to conduct a business, for instance, without knowing what the value of your assets or your accounts receivable will be in the next month, let alone the next year.

To some extent, supply can also be unpredictable. Because bitcoins are based on complex algorithms, they must be stored as electronic records. If the records are not backed up, then those bitcoins cannot be re-created, thus causing a contraction of the money supply. So if a rich person lost many bitcoins, or if significant numbers of bitcoins are lost over time, the contraction of the money supply may slow the economy.

There is a great benefit to being able to manipulate the money supply, which is why the gold standard was abandoned by every country years ago. An economy needs a certain amount of money to function properly, to keep values steady. Although inflation decreases the value of money, inflation is kept steady by the central banks, so it is largely predictable. If the central banks did not have the ability to create or destroy money as needed, then the value of currency would fluctuate with economic conditions. Indeed, because gold and bitcoins can actually increase in value, people will tend to hold onto their money, hoping that it will increase in value, just as the Japanese people had done in their deflationary environment.

To serve as a unit of account and as a store of value, the creation and destruction of money must be carefully controlled according to the needs of the economy. If both the creation and destruction of money cannot be regulated, then the money itself will fluctuate in value, reducing its value as money and reducing the efficiency of the economy because the exchange rate of the present value of costs and revenue with their future value will be unpredictable. Present value and future value of investments is used extensively by investors to decide which investments are best and by businesses to decide which capital investments would yield the best returns. The calculation of the present value and future value of anything requires not only an interest rate but also a stable unit of money that is not going to vary unpredictably in value; otherwise, any calculated present value or future value will be meaningless. If I have 100 bitcoins earning 5% annually, then, at the end of 1 year, I will have 105 bitcoins. But how much those 105 bitcoins will be worth 1 year from now is anybody's guess.

It is true that the government can abuse the printing of money, but the government can abuse many things, such as can be seen presently in Russia. It is up to the people to ensure that the government works for its best interest. But an efficient economy requires money that not only serves as a unit of exchange, but also as an accurate unit of account and as a predictable store of account. So, Ron Paul's desire to end the Fed and go back to the gold standard is never going to happen. Likewise, bitcoins will mostly be bought as a speculative investment.

News

- As Plastic Reigns, the Treasury Slows Its Printing Presses - NYTimes.com - a good article about the decline in the use of currency and coins. It also points out that the seigniorageearned by the United States in 2010 was over $20 billion and also points out that businesses do not have to accept cash, since the phrase "THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE" that is printed on all United States currency applies only to lenders or creditors, and not to merchants who sell goods or services.

- BBC News - Printing Money: How to Create a Currency

Resources

- How to Detect Counterfeit U.S. Money

- http://www.moneyfactory.gov/newmoney/flash/interactivebill/5_InteractiveNote.html - An excellent Flash presentation of the new Federal Notes security features.

- The Future of Money and Monetary Policy

- Central Bank History - Currency Images | The Federal Reserve Bank of Minneapolis

- Turn In Your Bin Ladens

- The Bureau of Engraving and Printing Store - Here, you can buy new bills or coins directly from government agency that creates them.

No comments:

Post a Comment